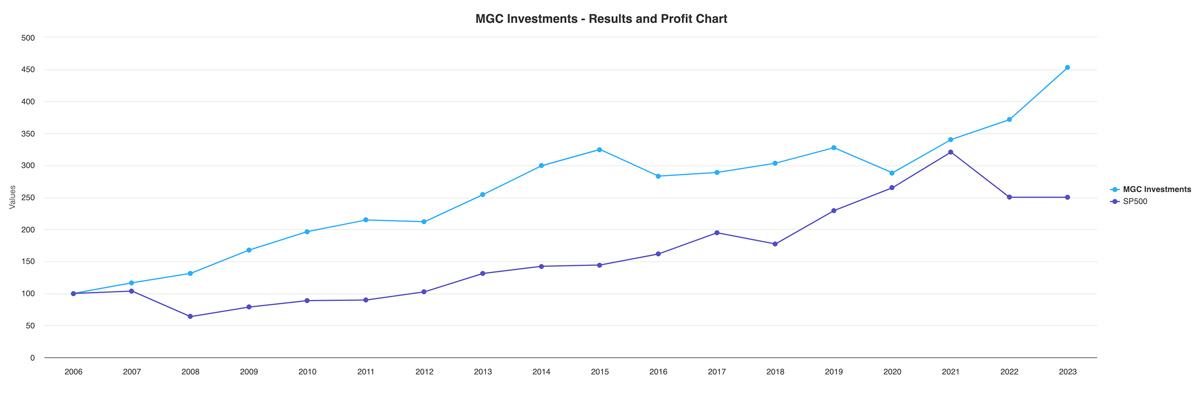

Click the image above to open the Revenue and Profit Chart

The mission of MGC Investments is to create consistent profits for our clients in all market conditions, through our values of professionalism, transparency, and safety.

MGC Investments aims to achieve a minimum performance of 10% yearly with a lower volatility than the stock market, but above all, to ensure a low, limited and calculated risk.

This is done by utilizing techniques which preserve clients’ investments in bear markets to protect their invested capitals.

Since 2000 MGC Investments has always achieved annual performances exceeding 9%, with a peak of 27.8% in 2009, and average annual performances of + 17.8%, compared to the average +5.7% of major stock markets for the same period.

These results were possible thanks to our advanced investment strategies that have enabled us to achieve excellent results even during the two most difficult periods of the world economy in the last 12 years: +8.2% in 2000 and + 12.58% in 2008.

MGC Investments’ positive results are even more significant in light of the New Economy technology market bubble of 2000 and the mortgage sector crisis in 2008, with disastrous consequences for many banks (Lehman Brothers and others) and heavy losses of more than 60-70% on average in individual markets.

93% of MGC Investments’ transactions are positive thanks to the use of multiple innovative investment strategies. MGC Investments adopts differentiated investment strategies based on the different market conditions and our clients’ objectives and risk tolerance to eventually ensure significant returns in bull and bear markets.

Our strategies are based on the macroeconomic analysis of the global financial markets, the economic analysis of the country of reference and the investment sector, in which to invest and an in-depth technical analysis of market cycles.